Insider Dealing and Market Manipulations fines - what should we learn from it

10 minute read

Introduction

Following on from my previous lesson about market abuse regulation, today I would like to discuss the world's largest insider trading and market manipulation cases.

It's always a good idea to know the regulations and rules, but it's even more important to understand the practice. And the best way to learn it is through real-life examples, ensuring that you can protect your organization and increase your levels of control.

The stock exchange has always been a very appealing place for investors from all over the world. This is where the wealthy become even wealthier, where the lucky get even luckier, and where you can lose all your money in a single second. This is the temptation to get rich quick.

Market manipulation has a long history, dating back to the establishment of the first stock exchanges. Unfortunately, this is something that cannot be avoided. Regulators are attempting to combat illegal trading activities by imposing higher fines and even prison sentences, but someone somewhere will try to cheat the system.

The most significant insider trading and market manipulation cases in history

Ivan Boeski - 1987

Global regulators assume that if a market participant has committed a crime at least once, they will commit it again. This is how Ivan Boeski, one of Wall Street's most prominent speculators, was exposed in the 1980s. He was sentenced to three years in prison in 1987. The reason for this was the illegal gain of $ 50 million from obtaining confidential information from Denis Levine. Because of his success in stock trading, he was nicknamed "Ivan the Terrible."

Mr. Boesky was a specialist in risk arbitrage, which is a term that describes when stock traders try to exploit market inefficiencies, such as when a trader believes one company’s stock has been undervalued. Arbitrage traders frequently buy large blocks of stock in a company in the hope that the price will rise, particularly if the business is about to be acquired.

Risk Arbitrage key points:

- Risk arbitrage is an investment strategy used during takeover deals that enables an investor to profit from the difference in the trading price of the target's stock and the acquirer's valuation of that stock.

- After the acquiring company announces its intention to buy the target company, the acquirer's stock price typically declines, while the target company's stock price generally rises.

- In an all-stock offer, a risk arbitrage investor would buy shares of the target company and simultaneously short sell the shares of the acquirer.

- The risk to the investor in this strategy is that the takeover deal falls through, causing the investor to suffer losses.

Ivan Boesky decided to cooperate with federal authorities. He pleaded guilty to a single charge of making false statements to the government and agreed to pay a then-record $100 million fine.

Martha Stewart - 2001

In December 2001, media empire owner Martha Stewart sold her shares in pharmaceutical company ImClone Systems, the day before its price plunged. She used confidential information which was not public yet, which she received from her broker, Peter Bacanovic. Suspected of insider trading, Martha Stewart was found guilty in March 2003. However, in the absence of clear evidence, the authorities had to drop this allegation and accused her of obstructing the investigation of the transaction.

A New York court sentenced her to five months in prison. In addition, the court sentenced her to five months of house arrest, two years of judicial supervision, and a fine of $ 30,000. In March 2004, Martha Stewart was acquitted of another charge: securities fraud for which she was punished by a 10-year prison sentence. The broker Peter Bacanovich was found guilty in March 2004 for the same crimes as his client and perjury.

The Stewart case was one of numerous scandals in the US corporate world. Since then, the US government has tightened the penalties for committing financial crimes. Martha Stewart’s Omnimedia shares rose 11% after the court ruling.

Bernard Madoff - 2009

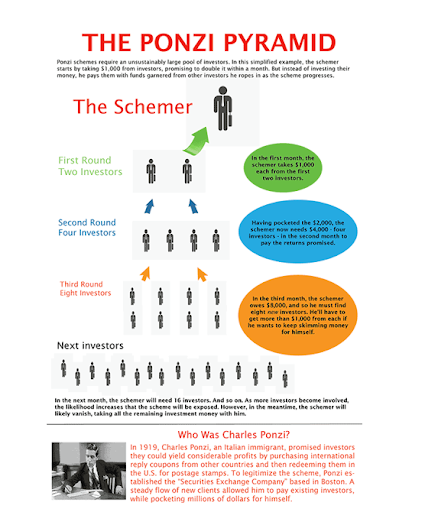

Bernard Madoff, an American financier and broker, was sentenced to 150 years in prison at the age of 71. Following a famous Ponzi scheme, he made investors lose billions of dollars. He organized the largest financial pyramid scam in history.

Madoff was well-known and well-positioned on the financial market with many years of experience. In 1960 he started his own business and helped launch the Nasdaq stock exchange. He was also a member of the National Association of Securities Dealers and advised the Securities and Exchange Commission on trading securities. With such a stellar reputation in the market, it's difficult to believe that someone like Madoff could pull off one of the biggest scams in history.

Madoff devised a strategy to avoid having to pay too much to his existing investors. He did everything he could to stay under the radar by keeping the scheme low-key. Madoff only targeted a small and exclusive group of investors. He always made certain that his paperwork was up to date and consistent so that the regulator had no concerns.

Madoff also did little to raise the ire of his investors. He convinced them that they could withdraw their money almost immediately, so they had no reason to suspect anything was wrong.

Some insider traders and market manipulators are referred to as rogue traders.

A rogue trader is a financial firm employee who engages in unauthorized, often high-risk activities that result in significant losses for the firm.

Nick Leeson - 1995

One of the most famous rogue traders was Nick Leeson. In 1995, he led to the biggest scandal in world banking history, which caused the collapse of Barings Bank. It all started when Leeson began to speculate on Nikkei 225 contracts in addition to his regular transactions. In this way, he transformed his low-risk stock-exchange activities into an aggressive investment portfolio.

Unfortunately, Leeson was a poor speculator; he lost money from the start, and his losses were covered by the bank because his funds were used to trade. Leeson hid all of the transactions in an unused account at Barings Securities, where the losses were compounding on a regular basis. He tried to cover it up, but it didn't go well for him. The hidden account balance was negative at the end of 1992, totalling £ 2 million. Barings Bank's balance was minus £ 23 million at the end of 1993, and minus £ 208 million a year later.

The bank lost £ 827 million in February 1995. Leeson forged bills, accounts, signatures, correspondence, manipulated accounting entries while securing flows from bank branches as well as from private clients' accounts. Leeson was detained at Frankfurt airport, from where he was deported to Singapore, charged and sentenced to 6.5 years in prison. However, he was released in 1999 after being diagnosed with cancer. Baring Bank filed for bankruptcy and was accepted by ING for a symbolic pound.

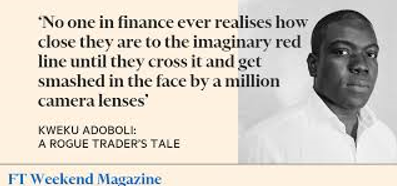

Kweku Adoboli - 2011

In 2011 Swiss Bank UBS lost US$2 billion, by the fault of only one person - Kweku Adoboli. He started as an intern at UBS in 2006 and was promoted to director in 2010 with a £200,000 yearly pay. Adoboli became the greatest rogue trader in the history of Great Britain. He was convicted in 2012 for losing $2.3bn of the Swiss bank UBS’s money.

He was working as a trader in the investment bank’s global synthetic equities division. He was booking fictitious hedging trades to hide the fact that he was exceeding his risk limits. This action exposed the bank to a bigger chance of loss than it could see. Adoboli also created a sort of internal slush fund where he and others could later cover daily losses. He never denied the methods he was using. Adoboli claimed that all his actions were meant to make UBS more money and that the bank turned a blind eye for years as his scheme was helping it make millions in profit.

FX scandal - 2015

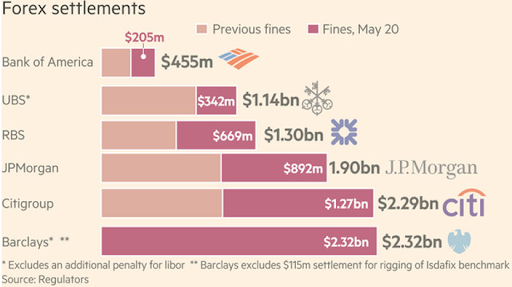

Six global banks agreed to pay $5.6 billion to settle allegations of rigging foreign exchange markets in 2015.

In addition, four banks agreed to plead guilty to conspiring to fix prices and rig bids in the $5.3 trillion per day Forex market. This was one of the most serious cases of banking misconduct since the global financial crisis.

JPMorgan Chase, Citigroup, Barclays, and the Royal Bank of Scotland used an exclusive chatroom and coded language to manipulate benchmark exchange rates between December 2007 and January 2013. They were attempting to increase their profits by referring to themselves as "The Cartel." "If you ain't cheating, you ain't trying," one of the traders said in the chat.

Regulators in Switzerland, Asia, the United States, and the United Kingdom began to investigate the Forex market's $4.7 trillion per day.

The Forex scandal involved the revelation, and subsequent investigation, that banks had been manipulating FX rates for at least a decade for financial gain.

Bloomberg News reported in June 2013 that “currency dealers said they had been front- running client orders and rigging the foreign exchange benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the benchmark rates are set. The behavior occurred daily in the spot market and went on for at least a decade according to the traders.”

Source: Vaughan, Liam; Finch, Gavin & Choudhury, Ambereen (12 June 2013). "Traders Said to Rig Currency Rates to Profit Off Clients". Bloomberg News. Retrieved 21 January2014.

J.P. Morgan - 2020

JPMorgan Chase & Co. agreed to pay more than $920 million in 2020 to settle market manipulation claims involving two of the bank's trading desks. This was the largest fine ever levied in connection with the illegal practise known as spoofing.

Over an eight-year period, 15 traders at the largest bank caused more than $300 million in losses to other participants in the precious metals and Treasury markets. For eight years, banks manipulated Treasury contract prices as well as secondary market trading in notes and bonds. This resulted in a loss of $106 million.

This case spans eight years and is related to a practice known as "spoofing," in which traders place large orders to buy or sell a security with no intention of carrying them out. This creates the appearance of demand or supply for a specific asset and aids in the movement of that asset in the direction desired by the trader.

It is against the rules to submit and cancel orders in an attempt to deceive other traders.

The settlement concluded the bank's criminal investigation, which resulted in the arrest of a half-dozen employees for allegedly rigging the price of gold and silver futures from 2008 to 2016. According to the settlement deal, ten JPMorgan traders caused losses of $206 million to other parties in the market.

Key takeaways

Every year at least one person in the world is fined for market manipulation or insider dealing. Some of those fines are relatively small, some of them cost billions, and some will put you in prison.

History shows that there is always someone who would try to scam the system. Many people in the financial industry have access to confidential information, which can be a daily temptation to break the rules.

What companies, individuals and investors should keep in mind when it comes to market wrongdoing:

- The regulator will always require companies to increase their risk controls

- The companies have to make sure to implement robust systems and controls to identify any suspicious activities and to report them immediately

- The employees should not ignore any suspicious and report it to the management as soon as any identified

- The regulators and companies should not base their assumption on the people’s reputation on the market and not ignore any complaints from the market participants(ex. Madoff)

- There is always someone who will try to manipulate the market, so investors have to make sure to also protect their funds

- Investors should not deal with an unauthorised brokers and submit their suspicious straight away to the regulator

- The company should impose higher disciplinary actions for the employees that are failing to comply with the companies policies

- It is true that you can make a quick profit while trading, but there is no such thing as a free money

- The truth will be revealed - many market participants believe that their actions will go unnoticed, but regulators are increasing their controls and paying close attention to what is going on in the market every year.

One wrongdoing action can cost companies and investors billions of dollars.

Last year, the entire world faced a global pandemic of Covid-19, which greatly increased the likelihood of new methods of market manipulation and insider dealing. People working from home with unsecured networks and access to confidential information necessitate new ways for companies and regulators to protect the market and investors. Furthermore, social media is becoming a new hotspot for criminals looking to manipulate the market and profit quickly. If we want to protect the market and innocent people, regulators should also make it easier for businesses to cooperate and report suspicious activity.

Sources:

- http://antykorupcja.gov.pl/ak/retrospekcje/retro/5359,Mr-Boesky-z-Wall-Street.html

- http://www.newsweek.pl/biznes/wiadomosci-biznesowe/wielki-powrot-marthy,17691,1,1.html

- http://money.cnn.com/2013/12/10/news/companies/bernard-madoff-ponzi/index.html

- http://www.aferyfinansowe.pl/afery-finansowe-na-swiecie/worldcom

- http://mutualfunds.com/education/biggest-stock-market-villains

- https://www.theguardian.com/business/2011/sep/15/who-are-worst-rogue-traders

- http://www.businessinsider.com/ubs-rogue-trader-kweku-adoboli-banking-culture-compliance-2016-8?IR=T

- https://www.businessinsider.com/how-bernie-madoffs-ponzi-scheme-worked-2014-7

- https://www.nickleeson.com/biography

- Vaughan, Liam; Finch, Gavin & Choudhury, Ambereen (12 June 2013). "Traders Said to Rig Currency Rates to Profit Off Clients". Bloomberg News. Retrieved 21 January2014

- https://www.cnbc.com/2020/09/23/jpmorgan-to-pay-almost-1-billion-fine-to-resolve-us-investigation-into-trading-practices.html

- Bloomberg

- Financial Times

- BBC

- Investopedia

- Business Insider