Financial Monitoring as a Type of Compliance Control: How Did It Emerge?

7 minute read

In 1989 countries of the Group of Seven decided to create the international Financial Action Task Force on Money Laundering (FATF). In fact, from that moment the term “financial monitoring” appeared in the world, which in one form or another is enshrined in the legislation of almost every country.

Financial monitoring, that is monitoring of financial transactions, is a type of compliance control that must obligatory be applied in banks and other financial institutions in order to prevent the introduction of proceeds of crime into circulation.

In its nature financial monitoring is a set of measures to control financial transactions that are subject to monitoring and include identification, verification of customers, record keeping of such transactions and collection of data about their participants. The task of financial monitoring is to control risky financial transactions and to detect attempts to legalise proceeds of crime or attempts to finance terrorism. Subsequently, the received information is sent to the State Financial Monitoring Service of Ukraine (SFMS).

The emergence of the institute of financial monitoring in Ukraine is associated with the adoption of the Law of Ukraine “On Prevention and Counteraction to Legalisation (Laundering) of Proceeds of Crime or Terrorist Financing” of November 28, 2002 № 249-IV.

The next stage was the adoption of a new law – “On Prevention and Counteraction to Legalisation (Laundering) of Proceeds of Crime, Terrorist Financing and Financing of Proliferation of Weapons of Mass Destruction” of October 14, 2014 № 1702-VII, which repealed the previous one.

And the last stage for today is the entry into force of the Law “On Prevention and Counteraction to Legalisation (Laundering) of Proceeds of Crime, Terrorist Financing and Financing of Proliferation of Weapons of Mass Destruction” of December 06, 2019 № 361-IX.

We will not consider retrospective aspects of the introduction and transformation of the institution of financial monitoring in Ukraine, but it is more appropriate to dwell on the current principles of financial monitoring as a separate component of compliance-risk control in banking and finance sectors.

Hereinafter the terms “financial monitoring” and “compliance” will be understood in the same way in order to avoid tautologies and to simplify the presentation of information.

The System of Financial Monitoring

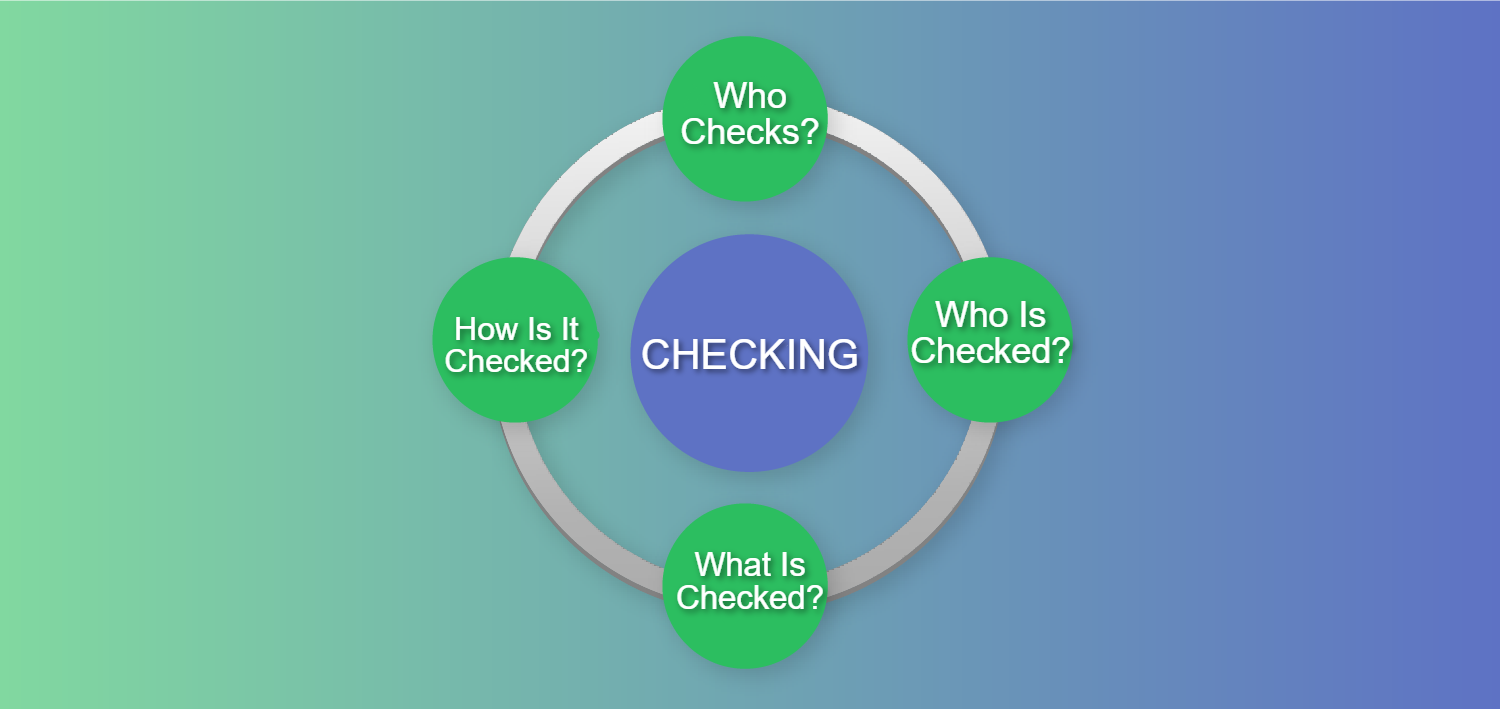

The system of financial monitoring can be divided into the following elements:

“Who Checks?”

The entities that conduct financial monitoring are called subjects of primary financial monitoring. Their common feature is that they all ensure conducting of financial transactions with money, securities or goods, including virtual assets. The most famous are banks, members of payment systems, commodity and stock exchanges and other entities providing financial services. The legislator separately identified special subjects of financial monitoring – they do not provide financial services but may be involved in the circulation of large amounts of money or have data about such turnovers: they are auditors, accountants, lawyers, notaries, real estate agents, traders of precious metals, stones and entities that hold lotteries.

All mentioned subjects are obliged to ensure the adoption of a risk-oriented approach while conducting their activity, transactions with their customers, although special subjects of financial monitoring have their own differences, established for each category separately.

“Who Is Checked?”

Everyone. Indeed, everyone who conducts transactions that fall under the signs of control, regardless of residency, gender, annual turnover and other characteristics, is checked, no matter whether it is an individual or a legal entity or even a public association.

However there are persons to whom special attention is paid:

- persons – residents of the states that do not follow the recommendations of international organisations in the field of combating money laundering;

- persons included in the list of persons connected with carrying out terrorist activities or on whom international sanctions are imposed (sanction compliance is applied here) and persons related to them;

- foreign politically exposed persons, members of their families and entities whose ultimate beneficial owners such persons are;

- persons on whom sanctions are imposed in accordance with the Law of Ukraine “On Sanctions”;

- persons with a place of registration/residence in the country classified as an offshore financial centre.

Such persons are automatically assigned a high risk of business relations and they are checked especially carefully.

“What Is Checked?”

To understand what exactly needs to be traced while exercising compliance control over financial transactions, it is important to know that at the highest level financial control is divided into mandatory (control over threshold financial transactions) and optional (control over suspicious financial transactions).

Mandatory financial control has clear criteria, among which one mandatory main sign and several mandatory optional signs are distinguished, of which at least one must be present in order to exercise control.

The main sign is as follows: the amount of a transaction equals or exceeds 400 thousand UAH (or equivalent in foreign currency).

Mandatory optional signs:

- if any party of a transaction (or the bank of either party) is registered, resides or is located in a country that does not follow international recommendations as to combating money laundering;

- if a transaction is carried out by a politically exposed person (a person who performs or performed significant political functions: the President, a member of the Cabinet of Ministers, a People’s Deputy, heads of the highest authorities, the head of the Supreme Court, Constitutional Court and the highest specialised courts, leaders of political parties, etc.), a member of his/her family or a related person;

- transfer of funds abroad;

- a financial transaction with cash (depositing, transferring, receiving).

In order for a financial transaction to be subject to mandatory financial control, it must have a basic sign (the amount of 400 thousand UAH or more) and at least one of the mentioned optional signs. In such circumstances a subject of financial monitoring switches on the mechanisms established by it for proper control over conducting such a transaction.

Optional financial control is exercised by a subject of financial monitoring according to the signs defined by the subject itself in its internal documents. Such control is aimed at identifying the transactions that do not fall under the criteria of mandatory financial control, but with the help of which proceeds of crime can also be legalised.

While exercising optional control, the amount does not matter, a subject traces other signs which may indicate the illegality of a financial transaction, that it establishes independently, taking into account typological studies prepared by the specially authorised body (SFMS).

“How Is It Checked?”

Subjects of primary financial monitoring must ensure proper checking of customers, that includes identification of a customer (receipt of documents from a person) and verification of a customer (establishment of the fact that the received documents belong to the person); detecting the ultimate beneficial owner of a customer; recognising (understanding) the purpose and nature of future business relations or conducting a financial transaction; conducting on a regular basis monitoring of business relations and financial transactions of a customer; ensuring the relevance of received and existing documents, data and information about a customer.

The process of financial monitoring is carried out by adopting a “risk-oriented approach”. What is it for those who are not involved in it? The risk-oriented approach means that a subject of financial monitoring develops internal documents that take into account the criteria of risks concerning transactions and customers on the basis of which it can identify a risky transaction without the need for the detailed and scrupulous study of each business transaction of each customer.

Simply put, every transaction that is accompanied by, for example, a bank, must pass a certain automatic test check according to certain criteria. And if the answers to all the questions of the automatic test are satisfactory, such a transaction is carried out without additional questions from the bank. However, if the answer to any questions of the test is negative, such a transaction is stopped for its more thorough study and, if necessary, for requesting additional information from the customer.

The more balanced a bank (or other controlling entity) approaches the creation of such a test, the more (or less) automatic its work with customers is and the less (or more) time it spends on transactions that will be erroneously classified as those with a high level of risk.

What Must a Subject of Financial Monitoring Do to Ensure Compliance with the Legal Requirements?

For the purpose of financial monitoring (in other words, compliance in the field of financial risks), the Law stipulates that the relevant subject is obliged to (as far as compliance is concerned):

- Develop and introduce internal rules of financial monitoring.

- Develop and introduce programmes for conducting primary financial monitoring.

- Appoint an employee responsible for conducting financial monitoring (responsible for the compliance-risk system).

- Ensure the conduction of customers’ identification and verification (KYC – know your client).

- Ensure the identification of financial transactions subject to financial monitoring (both mandatory and optional).

Of course, this is not a complete list of responsibilities of a subject of financial monitoring, but its other responsibilities concern the relations of a subject of financial monitoring with a customer and the specially authorised body and do not concern directly the organisation of compliance in this field.

Do you sell or supply goods? Do you perform works, provide services or supply goods? Make sure of reputational and legal reliability of a counterparty. To do this, order the analysis of compliance-risks of cooperation with a company or an individual entrepreneur by following the link